Kirkland, WA USA - Circa September 2021: Angled View of Cold, Flu, and Sinus Medications for Sale Inside a QFC Grocery Store Editorial Stock Image - Image of mucinex, nasal: 248947074

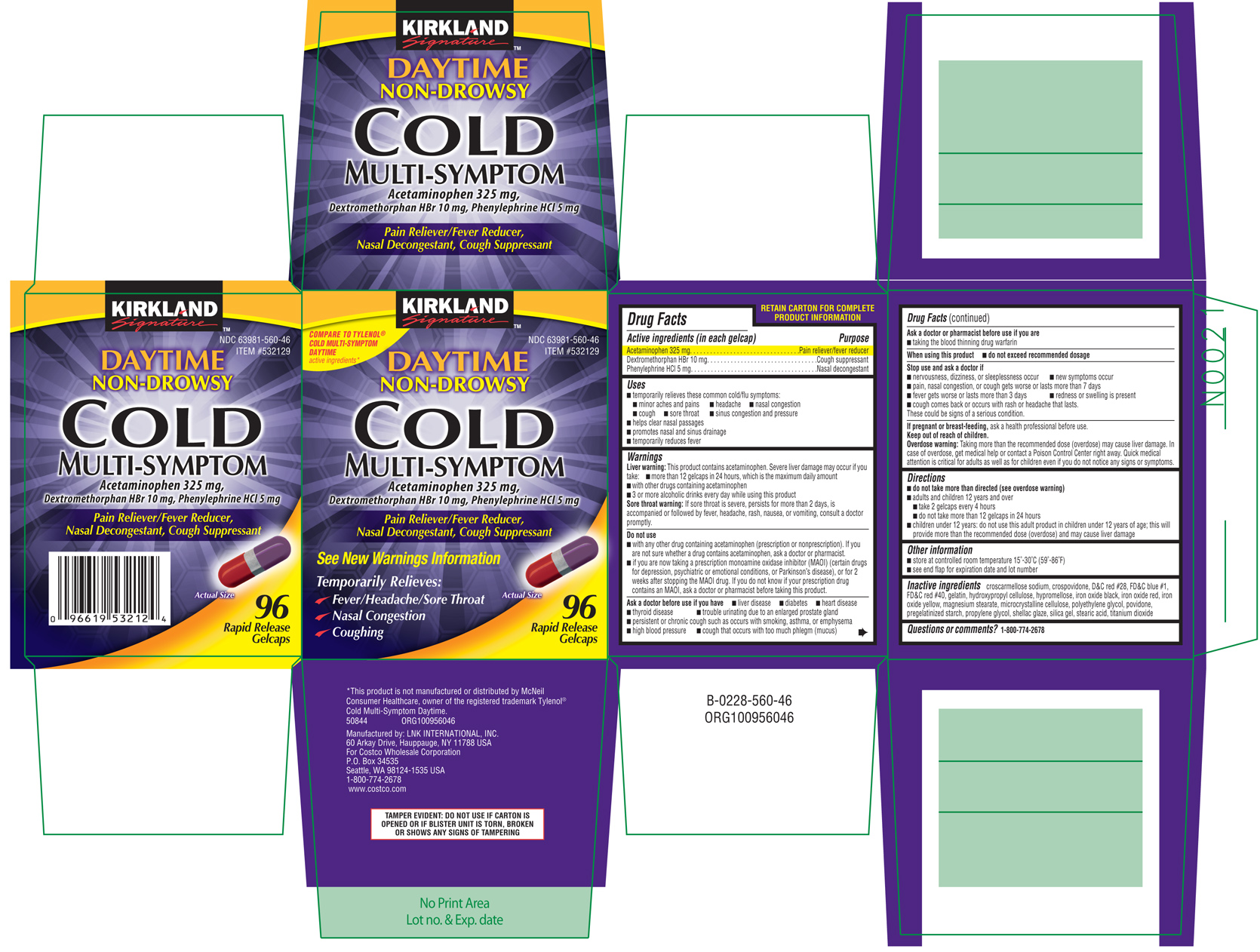

Costco Fall 2022 Superpost – The Entire Pharmaceutical Section - OTC, Vitamins & Supplements - Costco West Fan Blog

Costco Fall 2022 Superpost – The Entire Pharmaceutical Section - OTC, Vitamins & Supplements - Costco West Fan Blog