Amazon.com: lemon juicer squeezer,citrus juicer hand,manual exprimidor de limon - Easy to Use and folded storage,Citrus Fruits: Home & Kitchen

Metal Lemon Squeezer Hend Held Juicer Double Bowl Lemon Lime Squeezer Manual Orange Citrus Press Juicer Squeeze Kitchen Tools - AliExpress

Amazon.com: Phiwicsh Citrus Orange Juicer, Lemon Manual Hand Squeezer with Built-in 16OZ Measuring Cup Grater,Multi-function Manual Juicer with Multi-size Reamers and Non-Slip Base, Ginger Garlic Cheese Grater: Home & Kitchen

Lemon Lime Squeezer Manual Hand Press Fruit Citrus Orange Juicer - China Lemon Squeezer and Lemon Squeezer Commercial price | Made-in-China.com

Marlowe Easy Washable Lemon Squeezer Stainless Steel Lime Juicer For Orange, Lemonade Manual Hand Press Juicer With Comfortable Grip - Walmart.com

Amazon.com: ARK Reamer Lemon Squeezer - Citrus Juicer, BPA-Free, Anti-Slip Hand Press w/Measuring Cup - Easy to Use & Clean Manual Juicers for Fresh Orange or Lime Juice - Kitchen Gadgets :

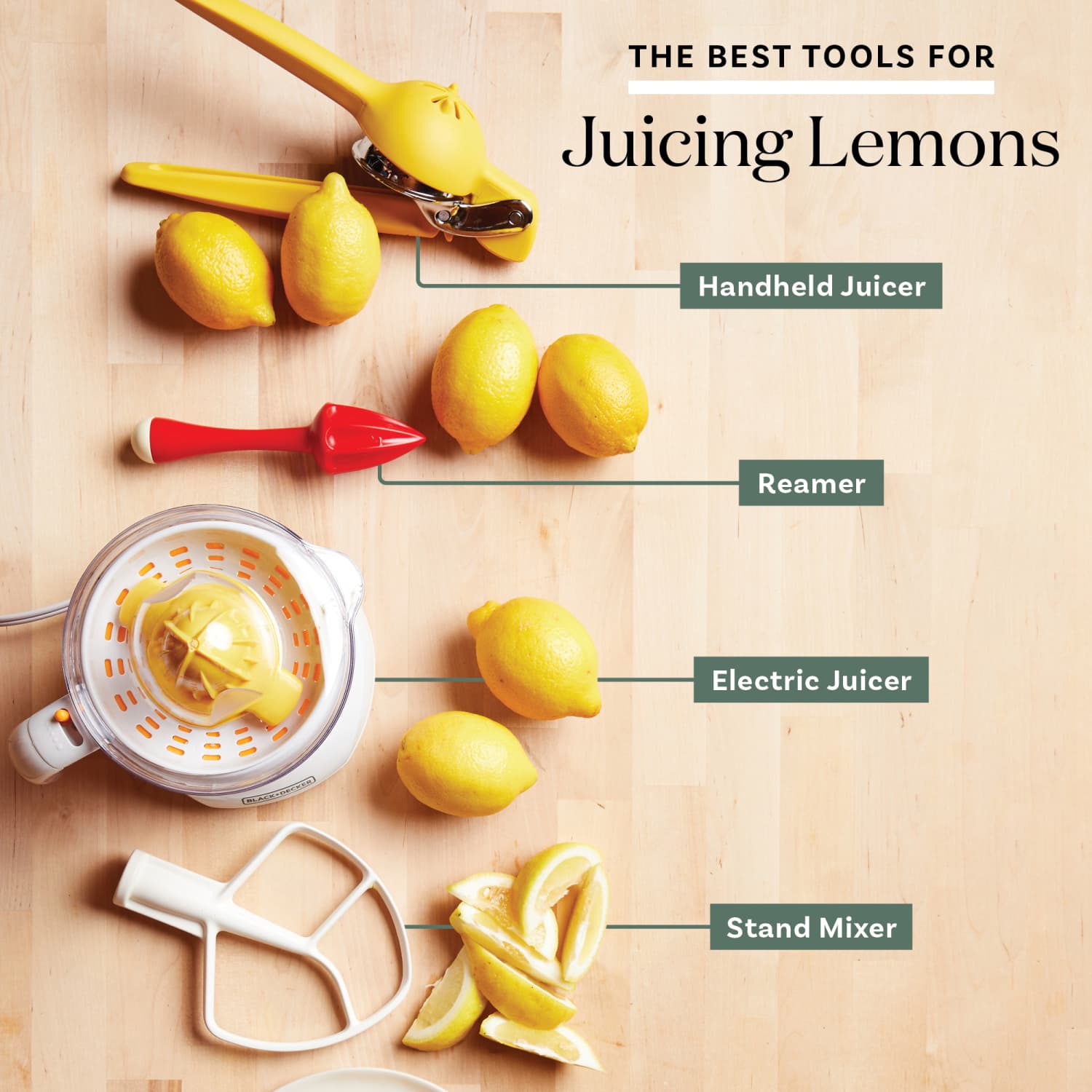

The Best Citrus Juicer (2022), Tested and Reviewed, Because Fresh Juice Is Always Better | Epicurious

Dropship Lemon Squeezer; Lemon Juicer; Citrus Juicer Handheld; Stainless Steel Juicer Hand Press; Lime Squeezer Bar Tool to Sell Online at a Lower Price | Doba

Heavy Duty Citrus Juicer & Lemon Juicer Hand Press With Curved Handle in 2023 | Lime squeezer, Hand juicer, Citrus juicer

Lemon Squeezer, Large Citrus Juicer and Lemon Juicer Hand Press Heavy Duty Lime Squeezer Easy Squeeze Manual Juicer Pinkiou Metal Hand Juicer Kitchen Tools and Gadgets for Making Fresh Juice (Gold) -

Amazon.com: Lemon Squeezer Hand Manual - Lime Hand Juice Lemon Squeezers Press Citrus Press Juicers Squeezer, Premium Quality Lime Lemon Squeezer, Manual Citrus Press Juicer: Home & Kitchen

Amazon.com: Lemon Juicer Squeezer Manual, Max Juice Extraction Lemon Lime Squeezer, Easy-to-Use Flat Lemon Squeezer with Leverage to Reduce Effort, Hand Juicer Citrus Squeezer with Built-in Strainer, Yellow: Home & Kitchen

:max_bytes(150000):strip_icc()/citrus-juicers-amanda_suarez-01-7472b2cde2ed40849fa8c7d82970a9cb.jpg)