FEIYABDF Toilet Plunger, Drain Unblocker, Powerful Electric Pneumatic Dredge Equipment. High Pressure Air Drain Blaster Cleaner

Luigi's Toilet Plunger: Powerful Toilet Unblocker to fit All Toilets, Clears and unblocks with a Powerful Bellows Action (2020 Heavy Du

Feiyabdf+Toilet+Plunger+Drain+Unblocker+Powerful+Manual+Pneumatic+Dredge+Equip for sale online | eBay

Amazon.com: THRUSTER Toilet Plunger for US Siphonic Toilets | Applies Hydraulic Pressure to Unclog The Most Persistent Blockages| Best Heavy Duty Toilet Plunger and Unblocker for US Blocked Toilets : Home &

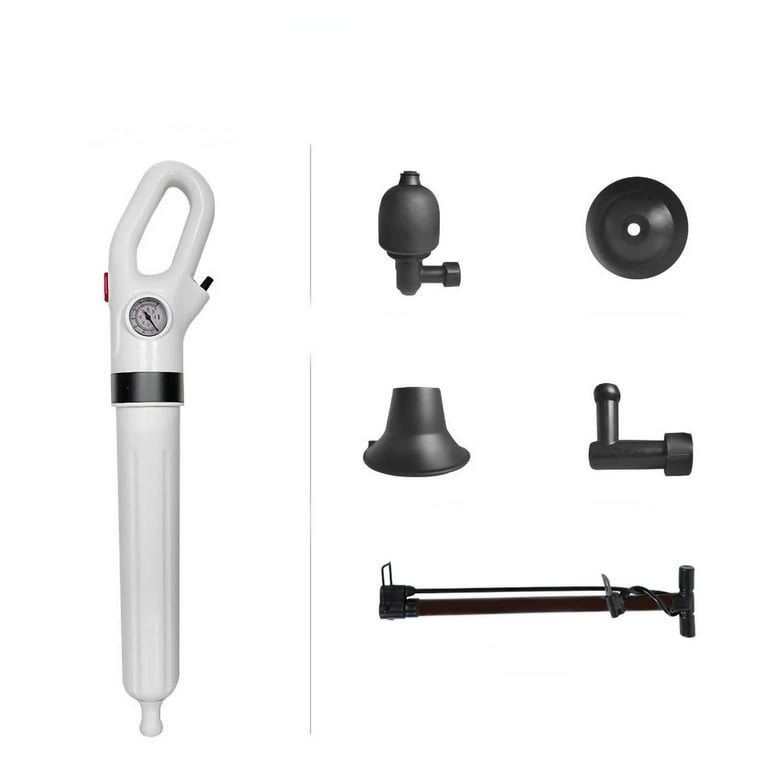

Amazon.com: Toilet Plunger, Drain Unblocker, Powerful Manual Pneumatic Dredge Equipment. High Pressure Air Drain Blaster Cleaner High Efficient, Applied to Kitchen, Bathroom, Clogged Pipe. : Home & Kitchen

Pipe Plunger Drain Unblocker High Pressure Sewer Dredge Clogged Remover Powerful Toilet Plungers Manual Pneumatic Dredge Tools - AliExpress

Risingstar Toilet Plunger, Drain Unblocker, Air Drain Blaster Kit,Manual Pneumatic Dredge Equipment,High Pressure Powerful drain clog remover Cleaner, Applied to Toliet, Bathroom, Kitchen. - Amazon.com

Powerful Pipe Plunger Electric High-pressure Air Gun Toilet Plunger Bathroom Sink Shower Kitchen Clogged Pipe Drain Unblocker

Toilet Plunger, Drain Unblocker, Powerful Manual Pneumatic Dredge Equipment, High Pressure Air Drain Blaster Cleaner High Efficient, Applied To Bathroom And Sink Clogged Pipe - Temu

New High Pressure Toilet Plunger Unblocker Pipes and Sinks Plunger Air Drain Blaster Cleaner Powerful Manual Pneumatic Dredge To - AliExpress

Powerful Drain Unblocker Air Power Toilet Plunger Toilet Plunger Pneumatic Toilet Plunger High Pressure Balloon Sealing Air Drain Blaster Powerful Drain Unblocker For Home Use 11th - Walmart.com

Toilet Plunger, Powerful High-pressure Drain Plunger Suction Cups, Toilet Unblocker Vacuum Plunger, Unblocker Suitable For Toilet, Bathtub, Shower, Sink - Temu

Toilet Plunger For Bathroom, Powerful High-pressure Drain Plunger Suction Cup, Toilet Unblocker Vacuum Plunger For Toilet Bathtub Shower Sink - Temu

Ckedes Toilet Plunger High Pressure Air Drain Blaster Gun Drain Clog Remover Tools Air Plunger Heavy Duty Drain Powerful Plungers for Toilet Unclog Toilet, Clogged Pipe, Floor Drain, Bathroom(Black) - Amazon.com

Toilet Plunger, Powerful High-pressure Drain Plunger Suction Cups, Toilet Unblocker Vacuum Plunger, Unblocker Suitable For Toilet, Bathtub, Shower, Sink - Temu

Toilet Plunger, Drain Unblocker, Powerful Plungers Toilet Opener Home Air Drain Blaster, Sewer Plumbing Tools For Bathroom, High Pressure Air Drain Blaster, Cleaner Applied To Kitchen, Bathroom, Clogged Pipe Dredge - Temu

Amazon.com: VTNXUN Toilet Plunger, Drain Unblocker, Powerful Plungers for Bathroom, High Pressure Air Drain Blaster Cleaner Applied to Kitchen, Bathroom, Clogged Pipe Dredge : Health & Household