![SOLD ‼️ ✦ canon powershot sd1000 for sale! [semi rare] ✦ P1,999 ONLY !!! 🔴 tested and working release date: 2007 specs: - 7.1… | Instagram SOLD ‼️ ✦ canon powershot sd1000 for sale! [semi rare] ✦ P1,999 ONLY !!! 🔴 tested and working release date: 2007 specs: - 7.1… | Instagram](https://lookaside.instagram.com/seo/google_widget/crawler/?media_id=2905178060244873789)

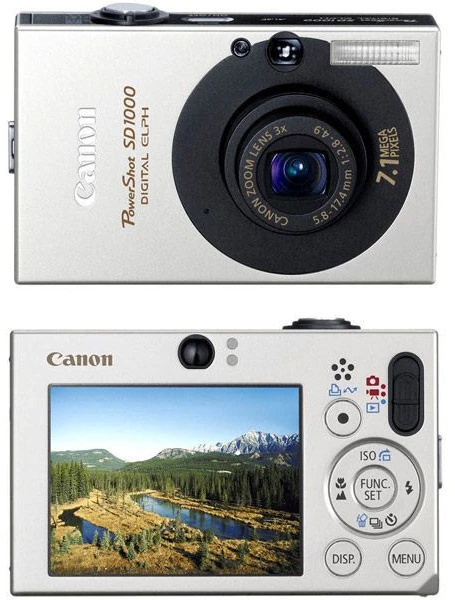

SOLD ‼️ ✦ canon powershot sd1000 for sale! [semi rare] ✦ P1,999 ONLY !!! 🔴 tested and working release date: 2007 specs: - 7.1… | Instagram

Gomadic Portable External Battery Charging Kit suitable for the Canon Powershot SD1000 Includes Wall; Car and USB Charge Options

classic straight USB data sync cable suitablefor the Canon Powershot SD1000 - Uses Gomadic TipExchange Technology

Amazon.com : Canon PowerShot SD1000 7.1MP Digital Elph Camera with 3x Optical Zoom (Black) (OLD MODEL) : Point And Shoot Digital Cameras : Electronics

Amazon Canada: Canon PowerShot SD1000 7.1MP Digital Elph Camera with 3X Optical Zoom (Silver) (Old Model)