Costco is Selling A Cooling Blanket That Absorbs Heat to Keep You Cool While You Sleep Kids Activities Blog

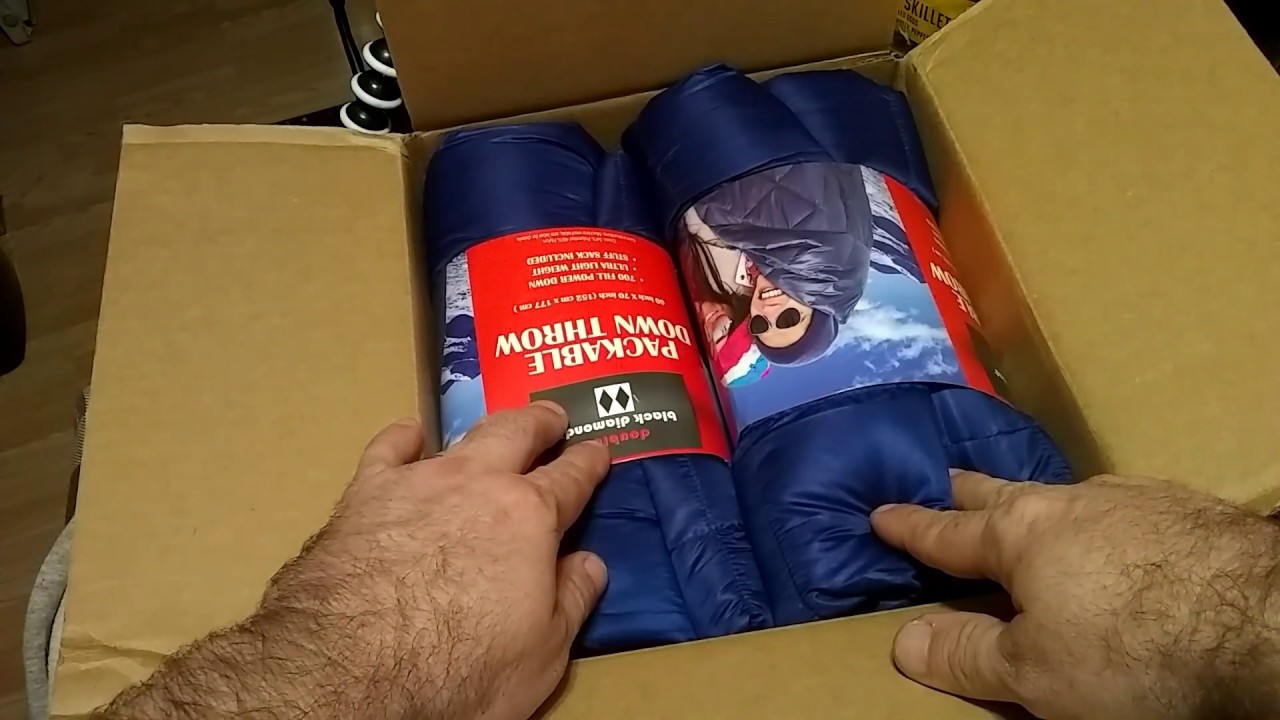

Friend recommended Black Diamond throws at Costco as a inexpensive option for backpacking. Haven't found the brand in the several months I checked, but this popped up. Good alternative? : r/camping

Throw blanket on sale again get them while they last. I bought 5 last year. With a 10 limit : r/Costco